Invest LikeAn IntelligentInvestor

Start investing with the right methodology.Jitta simplifies everything for you.

Orlog in

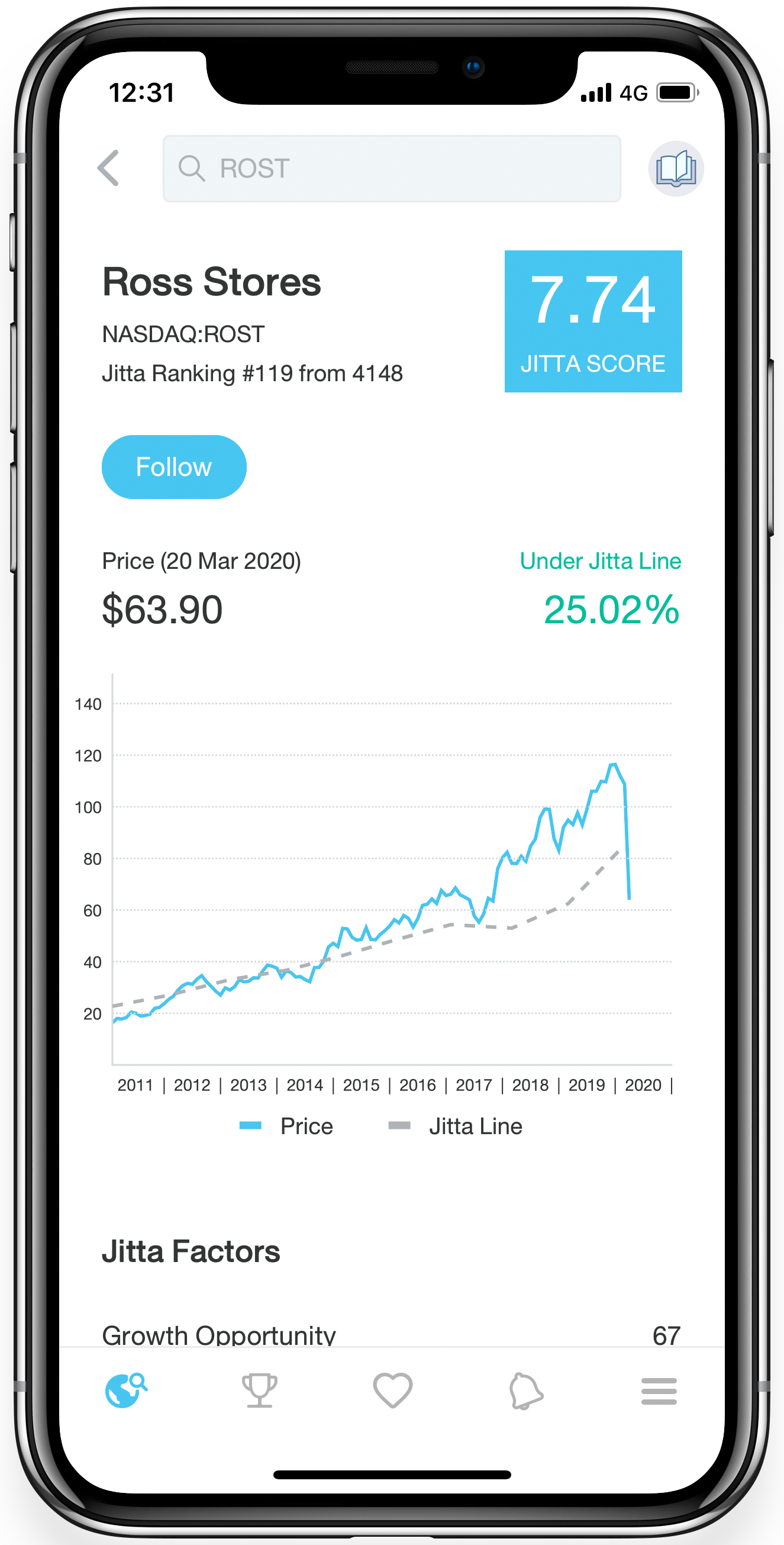

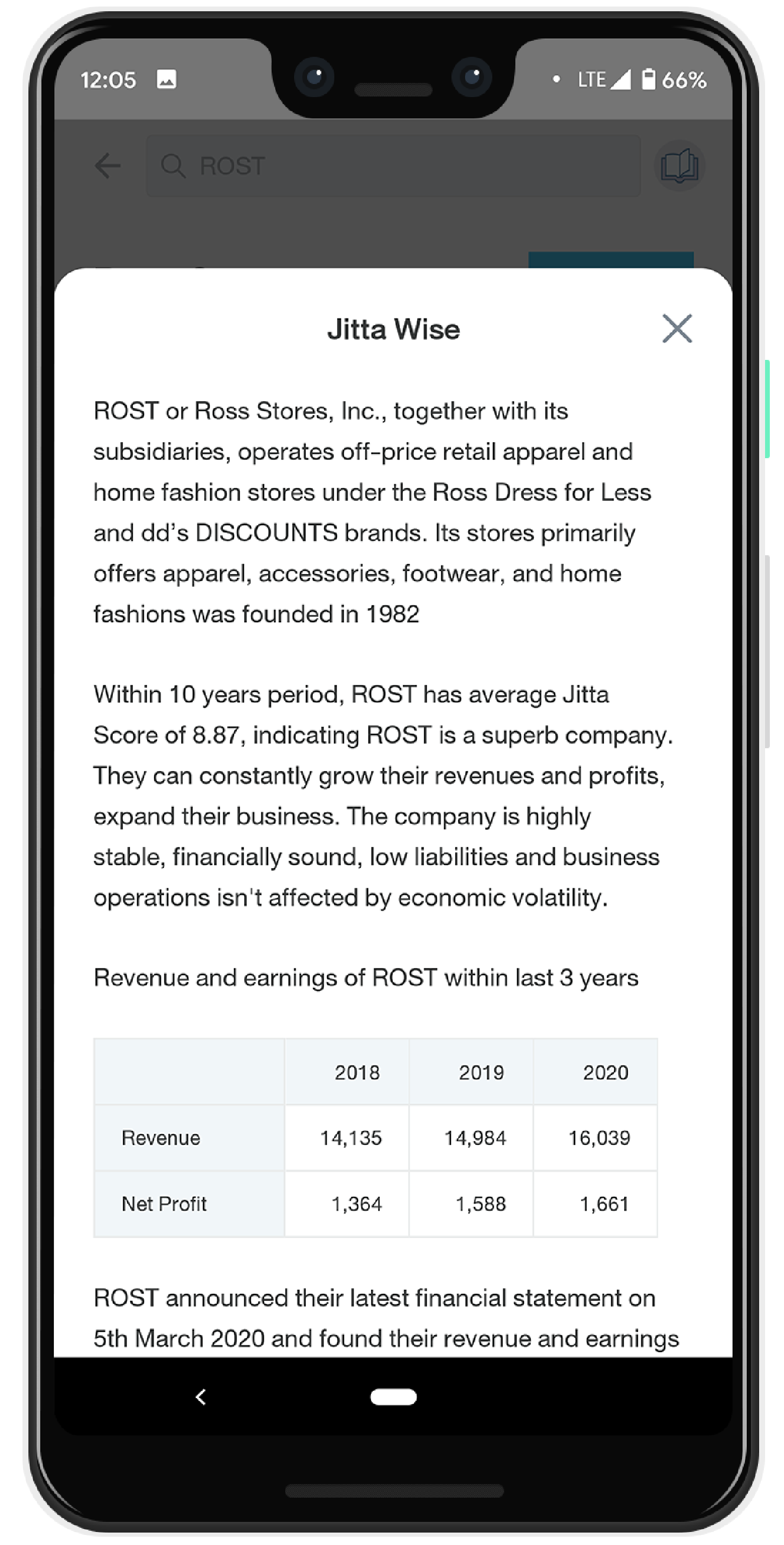

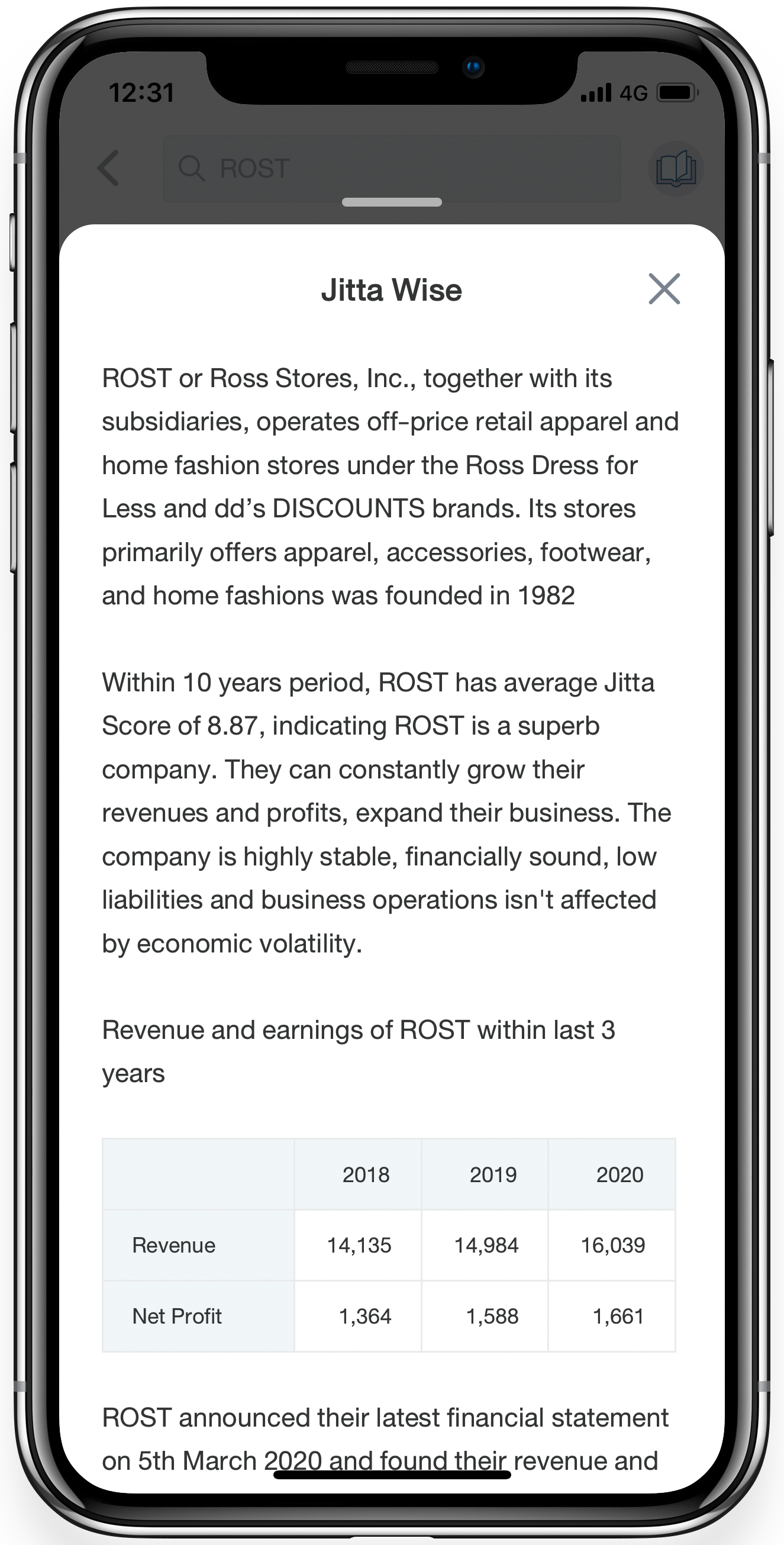

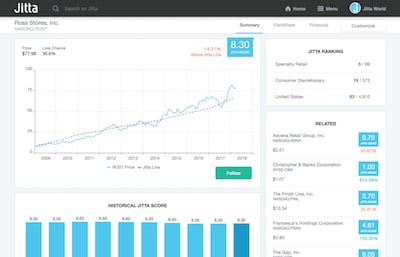

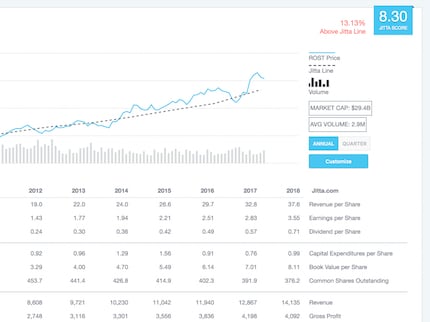

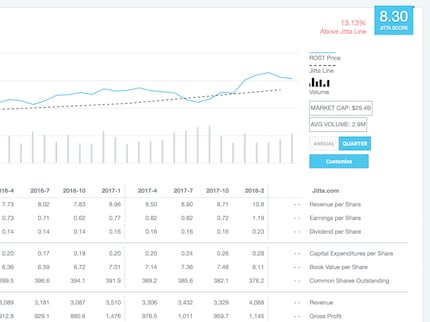

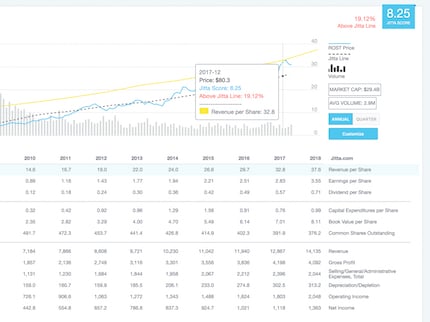

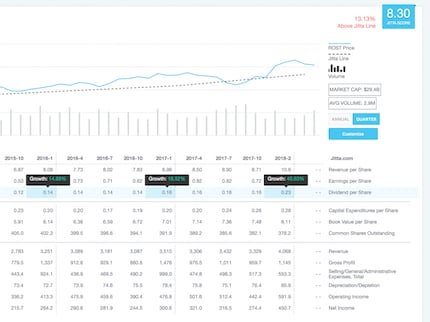

Ross Stores, Inc.

NASDAQ:ROST

19.76%

JITTA SCORE

Welcome to Jitta

A cutting-edge investing solution that helps you achievebetter returns through these powerful features.

Get smart stock analysis

Sit back and relax. Let Jitta do all the tedious work for you.We analyze complicated financial numbers and show youthe two most important factors when investing:

Together, they determine a company’s standing onJitta Ranking,

our ranking ofwonderful companies at a fair price.

Jitta Ranking Top 30 has been outperforming S&P 500 since 2009.

←

→

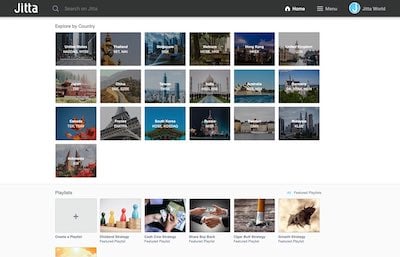

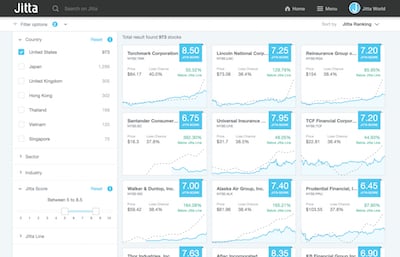

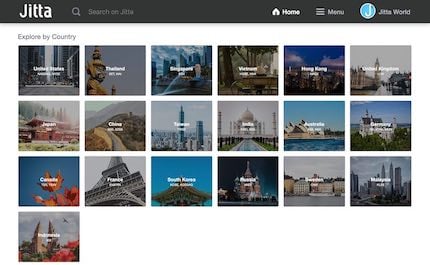

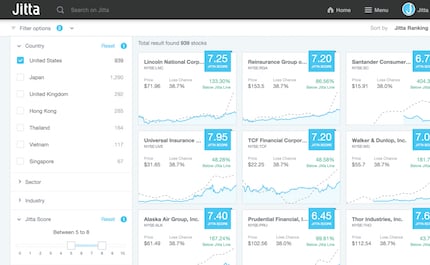

Discover high-potential investmentopportunities

Great investment options are all over the world!Jitta ranks high-quality, undervalued companies in 29 countries individually, giving you the hottest leads on hidden gem opportunities.

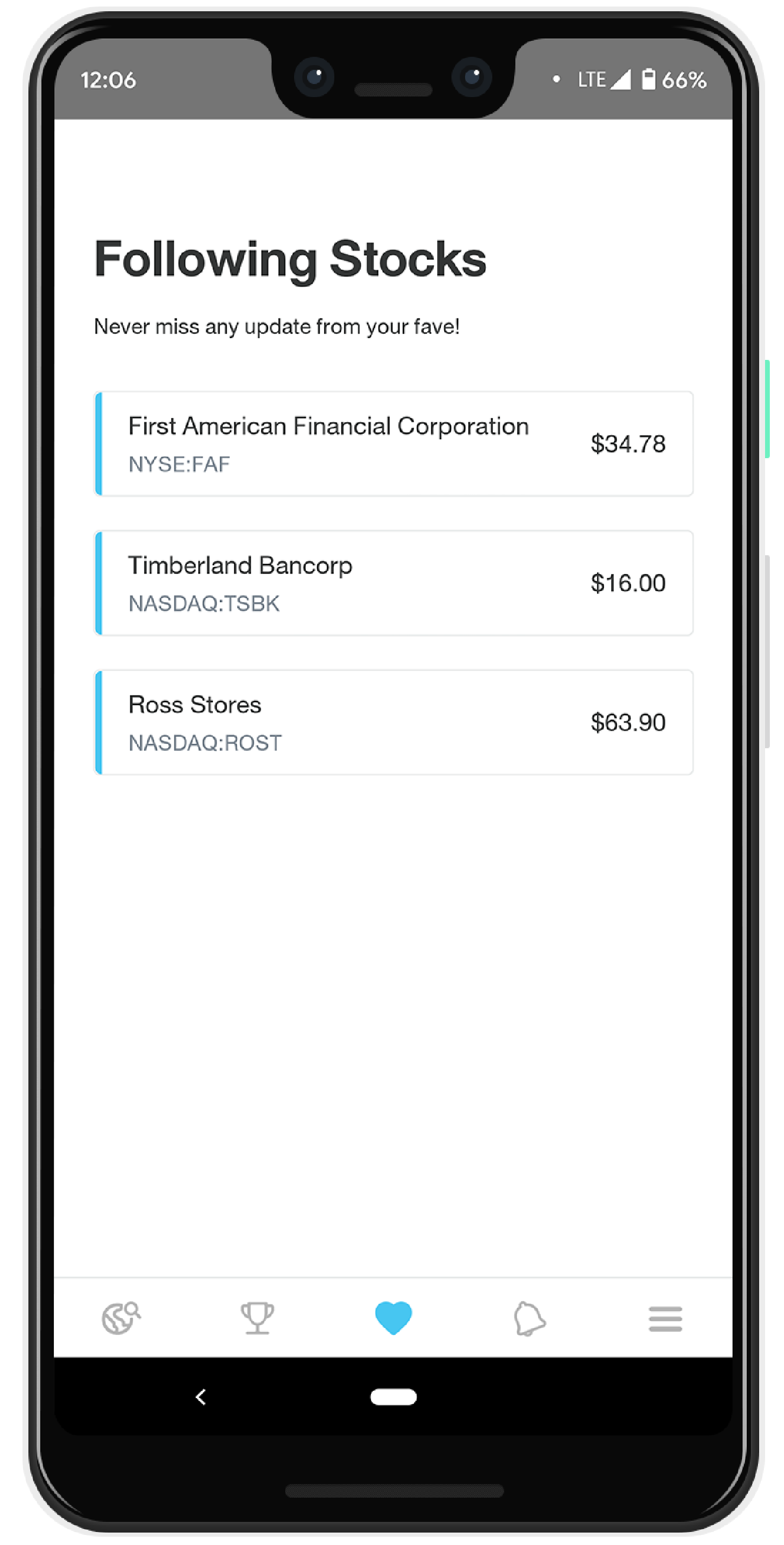

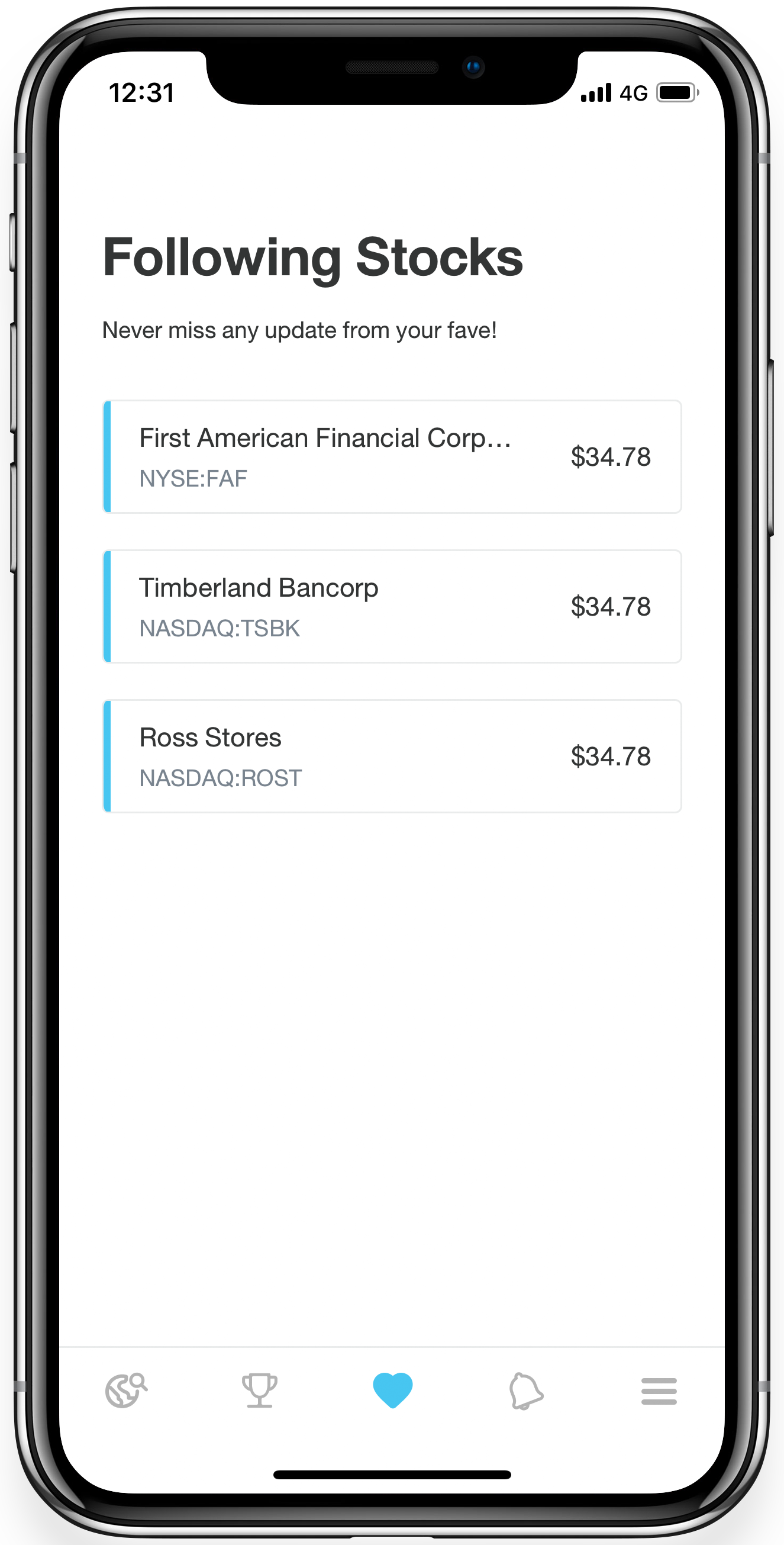

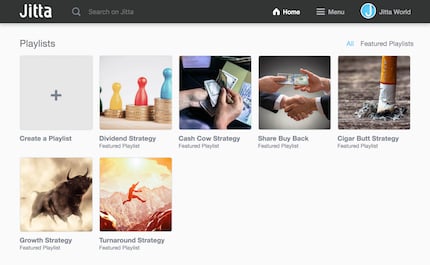

Follow popularinvesting strategies

Jitta presets screening criteria to help youfind stocks of all types, from dividend togrowth to turnaround, in a matter of clicks.

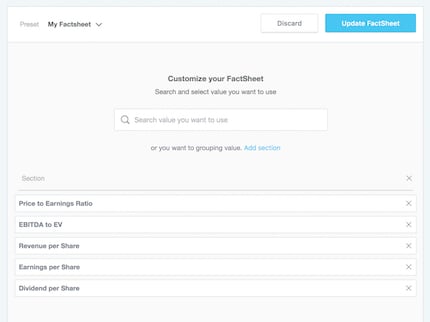

Create your owninvestment strategy

Jitta helps you screen stocks using morethan 100 criteria, including Jitta Intel and allthe key financial numbers, ratios and trendsinthe investment world.

Accesscomprehensivefinancial data

No more digging through endless financialreports. We compile the last 10 yearsand 10 quarters of company financials and give them to you free of charge!

Customize ithowever you want

Add your favorite financial indicators and arrangethem however makes the most sense to you.Financials are promptly updated within 2 days of filing.

See throughthe health ofa company

Relative changes and trend lines are instantly generated for you, making it easy to understandhow a company’s doing and zero in on the bestinvestment option.

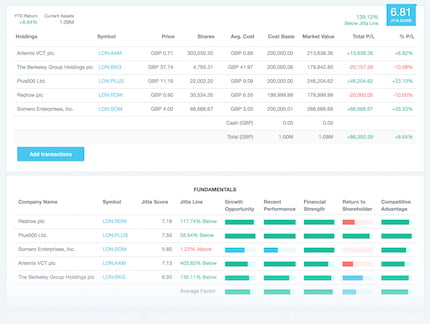

Optimizeyour portfolio'sperformance

Maximizing returns and minimizing risksare simple: our holistic tool lets you recordinvestments in multiple countries andcurrencies, assesses your portfolio’s quality,and gives you gain and loss indicators tofine-tune your investment strategy.

+%

%

%